In 2025, the imperative for small businesses to invest in cyber insurance is underscored by the alarming rise in cyberattacks, the substantial costs linked to data breaches, and the pressing need for compliance with ever-evolving regulations.

With a staggering 75% of small enterprises facing cyberattacks and recovery expenses averaging $120,000, it is evident that tailored cyber insurance offers essential financial protection and bolsters operational continuity.

This makes cyber insurance not merely an option, but a crucial element of a robust risk management strategy.

In a world where digital threats loom larger than ever, small businesses find themselves increasingly vulnerable to cyberattacks that could cripple their operations. With a staggering 75% of these enterprises having faced at least one online attack in the past year, the urgency for robust cyber insurance has never been more pressing.

This article delves into ten compelling reasons why investing in cyber insurance is essential for small businesses in 2025, illuminating the protective measures that can safeguard their financial stability and operational continuity.

As the landscape of cyber threats evolves, the question remains: how can small businesses ensure they are adequately prepared to confront these challenges head-on?

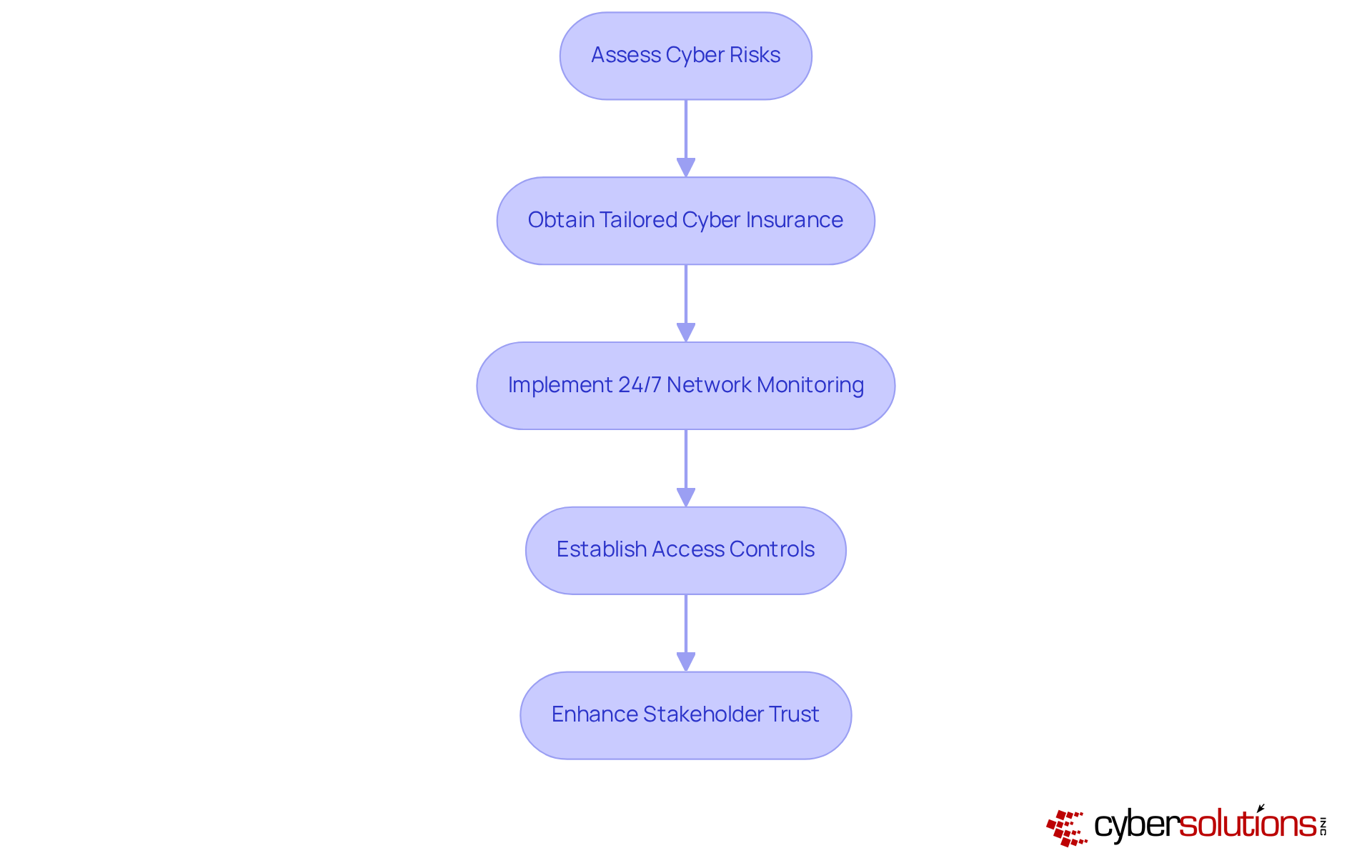

In today’s digital landscape, cyber insurance for small businesses is not just an option; it’s a necessity. Cyber Solutions Inc. provides a comprehensive suite of tailored insurance options specifically designed to address the unique risks these organizations face. By meticulously assessing these risks, Cyber Solutions ensures that clients receive protection that not only shields against digital threats but also aligns seamlessly with their financial strategies. This customized approach is crucial, especially considering that 75% of minor enterprises underestimate their vulnerability to cyberattacks, with many indicating they could not sustain operations if impacted by ransomware. Moreover, the average recovery cost from such attacks can soar to $120,000, underscoring the importance of adequate coverage.

To enhance this protective framework, Cyber Solutions delivers robust 24/7 network monitoring and alert services. This continuous monitoring identifies anomalies and potential vulnerabilities, providing immediate alerts and real-time insights that empower swift action to avert downtime or breaches. Such proactive cybersecurity measures are essential in defending against ransomware, phishing, and other malware threats, ensuring that suspicious activities are detected and neutralized before they escalate into significant risks. Additionally, the services encompass access controls and tailored restrictions, guaranteeing that only authorized personnel can access sensitive information.

Experts assert that cyber insurance for small businesses is indispensable, as it enables them to navigate the complexities of online threats without overspending on unnecessary coverage. By investing in customized digital protection, these enterprises can bolster their resilience against online dangers, minimize downtime, and expedite recovery following an incident. This strategic investment not only but also enhances stakeholder trust, illustrating a commitment to protecting essential information in an increasingly digital environment.

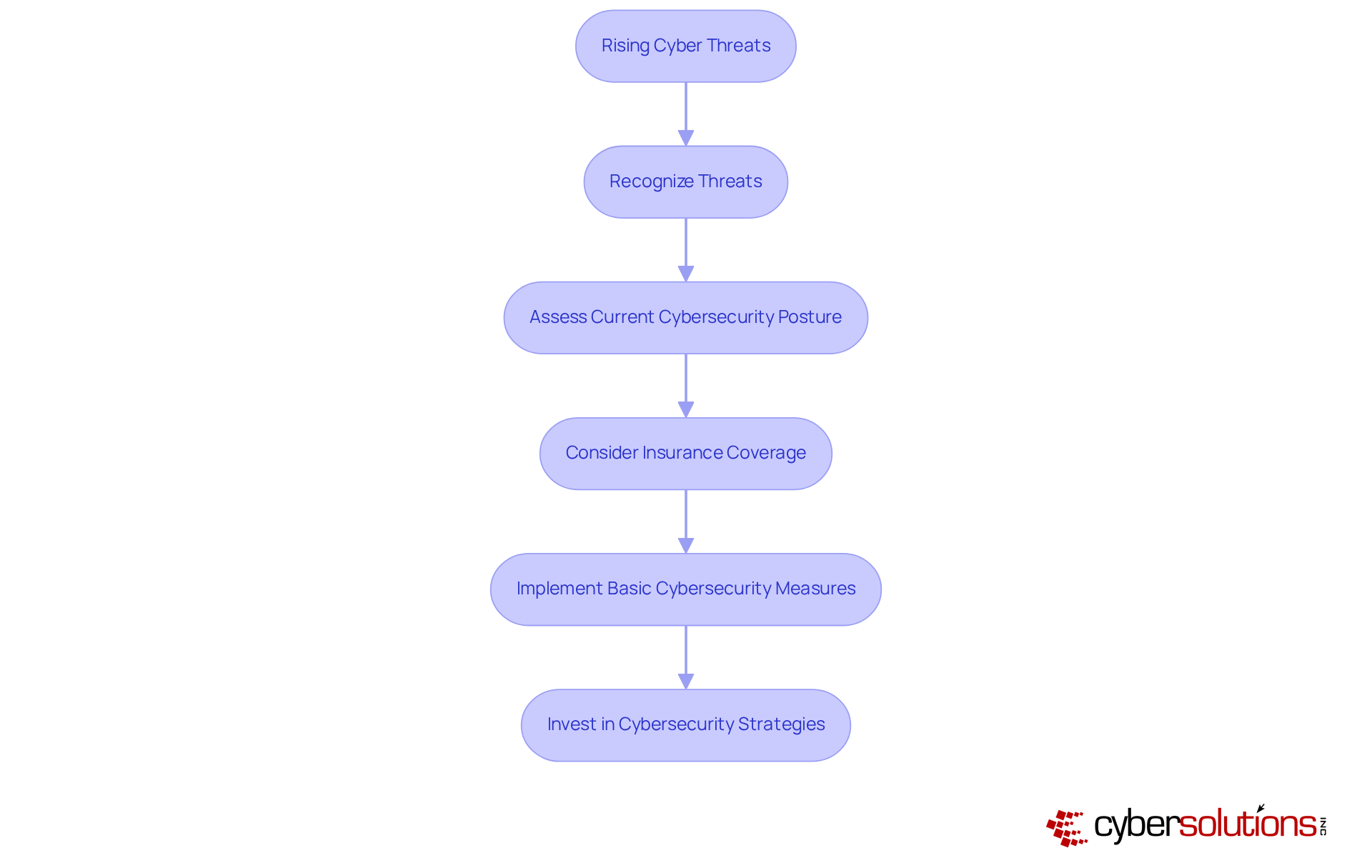

In 2025, minor enterprises face a troubling rise in digital threats, including ransomware, phishing, and data breaches. The complexity of these threats has intensified, highlighting the urgent necessity for digital insurance. Data indicates that 75% of minor enterprises experienced at least one online attack in the previous year, with ransomware incidents averaging $35,000 in costs each. Furthermore, nearly 60% of minor enterprises that suffer a significant cyberattack cease operations within six months, underscoring the severe financial repercussions of such incidents.

Real-world examples underscore this urgency:

Experts emphasize that cyber coverage is not merely a safety net but a crucial component of a comprehensive risk management strategy. With the average cost of a for small enterprises reaching $120,000 in 2025, having coverage can provide essential financial security and peace of mind. Additionally, many insurers now require companies to implement basic cybersecurity measures to qualify for coverage, further promoting proactive security practices.

A recent case involving a healthcare provider demonstrates the effectiveness of a layered cybersecurity approach, which includes rapid incident response and specialized expertise. By acting swiftly and having an incident response team on-site, the provider not only contained the threat but also improved its security measures, resulting in a significant reduction in potential future breaches. This example highlights the importance of investing in online security coverage as part of a broader strategy to safeguard operations and ensure long-term sustainability, particularly in the face of emerging digital threats. To mitigate risks, minor enterprises should regularly assess their cybersecurity posture and consider acquiring comprehensive digital protection to shield against potential financial setbacks.

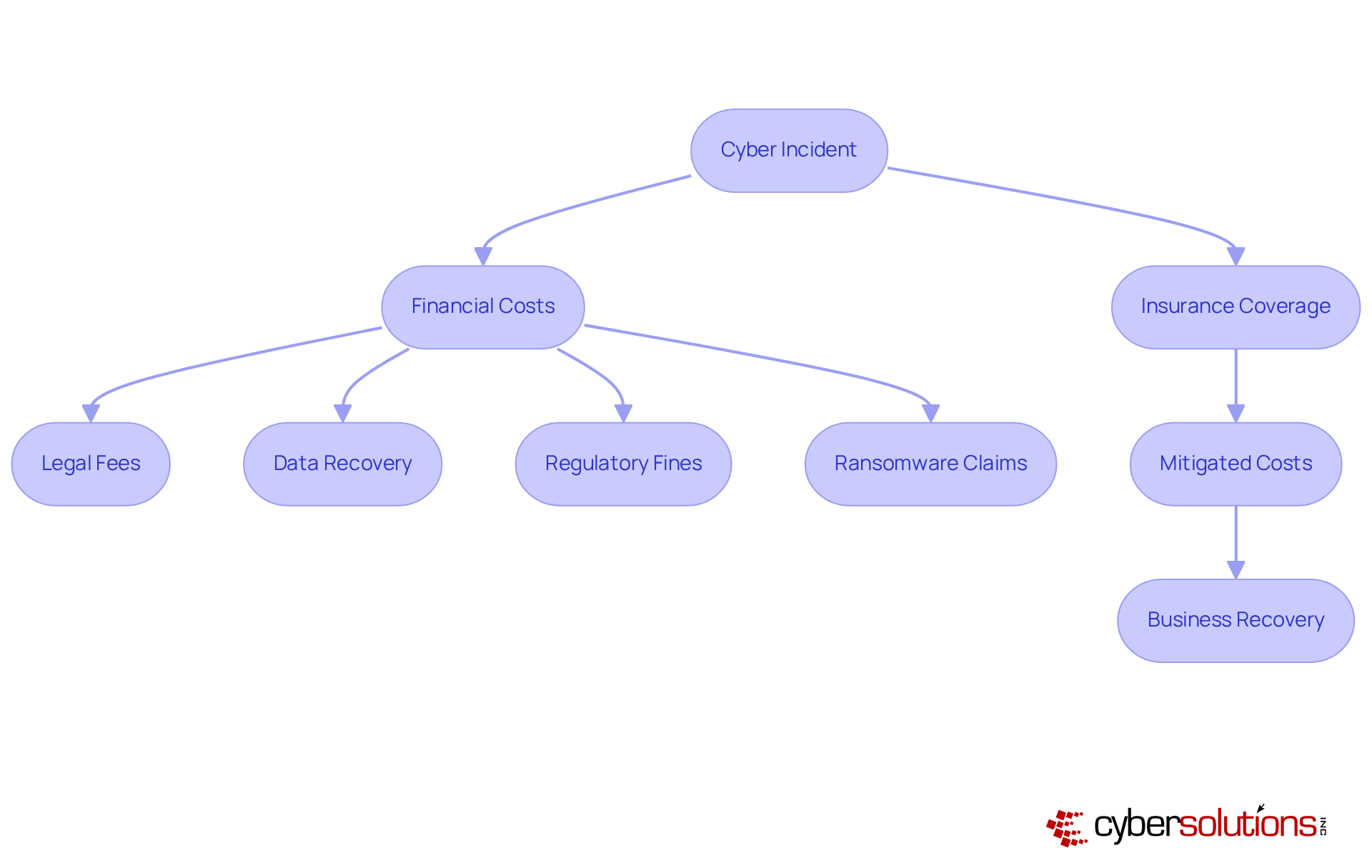

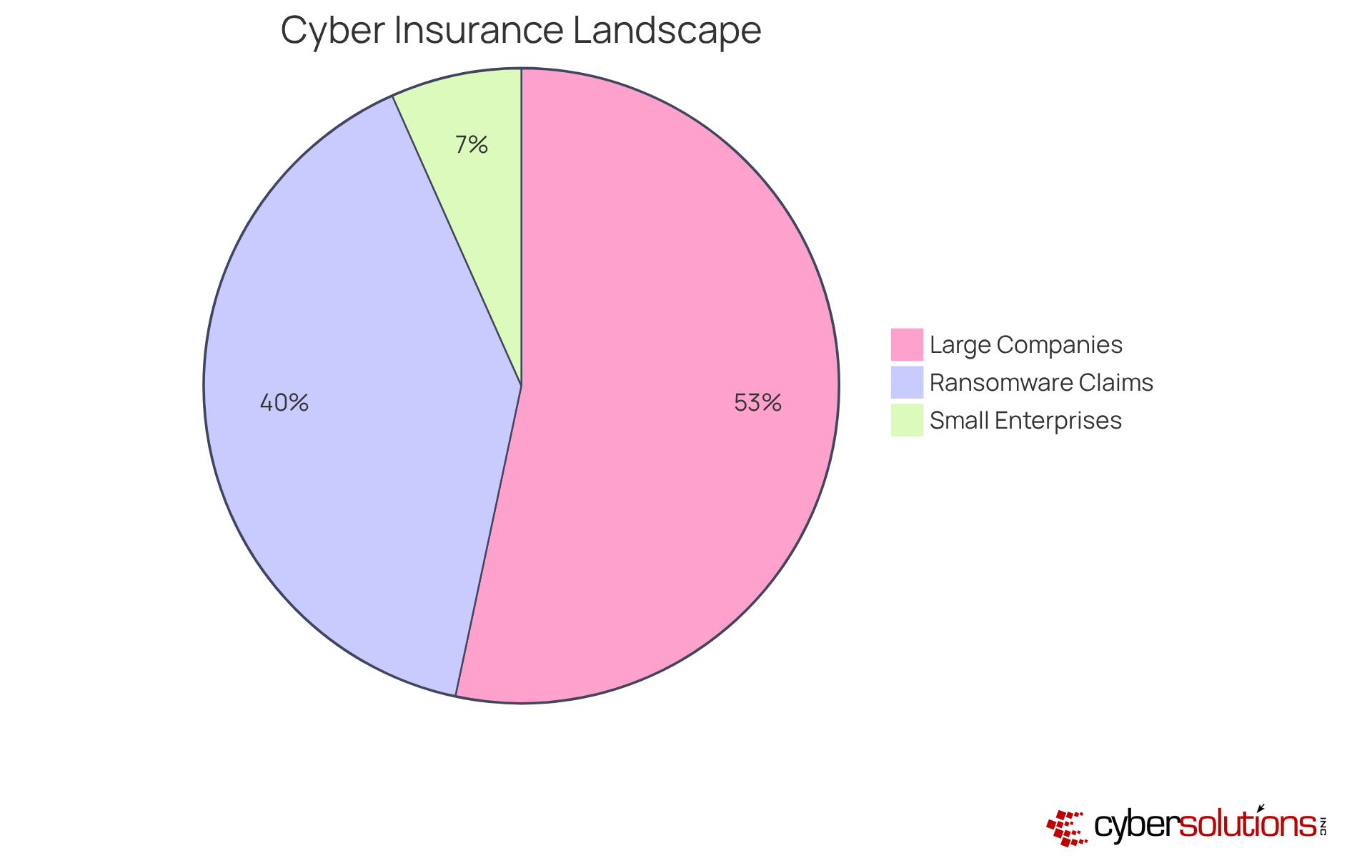

Cyber insurance for small businesses is an essential financial safeguard, especially as the frequency and severity of cyber incidents continue to escalate. The average cost of for small businesses can soar to approximately $120,000, encompassing expenses such as legal fees, data recovery, and potential regulatory fines. Without adequate coverage, these costs can threaten the very existence of a small enterprise.

In the first half of 2025, ransomware attacks represented 60% of the value of major claims, underscoring the substantial financial risks tied to such events. Cyber insurance mitigates these risks by covering a range of costs associated with data breaches and ransomware incidents, allowing businesses to recover swiftly and maintain operational continuity. For instance, companies that have implemented cyber protection measures have reported successful recoveries from incidents, showcasing the effectiveness of these policies in preserving their financial health.

Moreover, as digital threats continue to evolve, the necessity for comprehensive coverage becomes increasingly evident. A recent study revealed that claims related to data exfiltration were more than twice as costly as those without, emphasizing the need for businesses to reassess their coverage needs. Financial experts assert that investing in cyber insurance is not merely a precaution; it is a strategic decision aimed at ensuring long-term viability in an unpredictable digital landscape. By securing appropriate coverage, small enterprises can protect themselves from the potentially devastating financial repercussions of cyber incidents, ensuring their resilience during challenging times.

In today's digital landscape, the importance of robust cybersecurity cannot be overstated, especially for healthcare organizations. As they navigate unique challenges such as HIPAA compliance, the need for tailored cyber coverage becomes paramount. Factors like industry, size, and existing cybersecurity measures play a critical role in determining the appropriate coverage. For example, while healthcare entities grapple with specific compliance risks, financial institutions must contend with SEC regulations.

Cyber Solutions Inc. stands out by collaborating closely with clients to evaluate their distinct risk profiles. This partnership enables the creation of that provide optimal protection without incurring unnecessary costs. Such a tailored approach not only ensures adequate coverage against prevalent threats like ransomware and phishing attacks but also underscores the vital need for 24/7 threat monitoring. Continuous monitoring is essential; it allows for the detection and mitigation of suspicious activities before they escalate into significant threats, thereby enhancing the overall security posture of the organization.

As of 2024, a striking 87% of executives believe their companies are inadequately protected, underscoring the urgent need for robust cybersecurity measures. Moreover, it is crucial for businesses to fully understand policy exclusions and coverage limits of their cyber insurance for small businesses to avoid the pitfalls of being underinsured. By concentrating on tailored solutions, Cyber Solutions empowers organizations to effectively manage the complexities of digital protection, safeguarding their operations and bolstering overall resilience. CFOs are strongly urged to evaluate their current cyber coverage policies and consult with Cyber Solutions Inc. for customized solutions that specifically address their requirements.

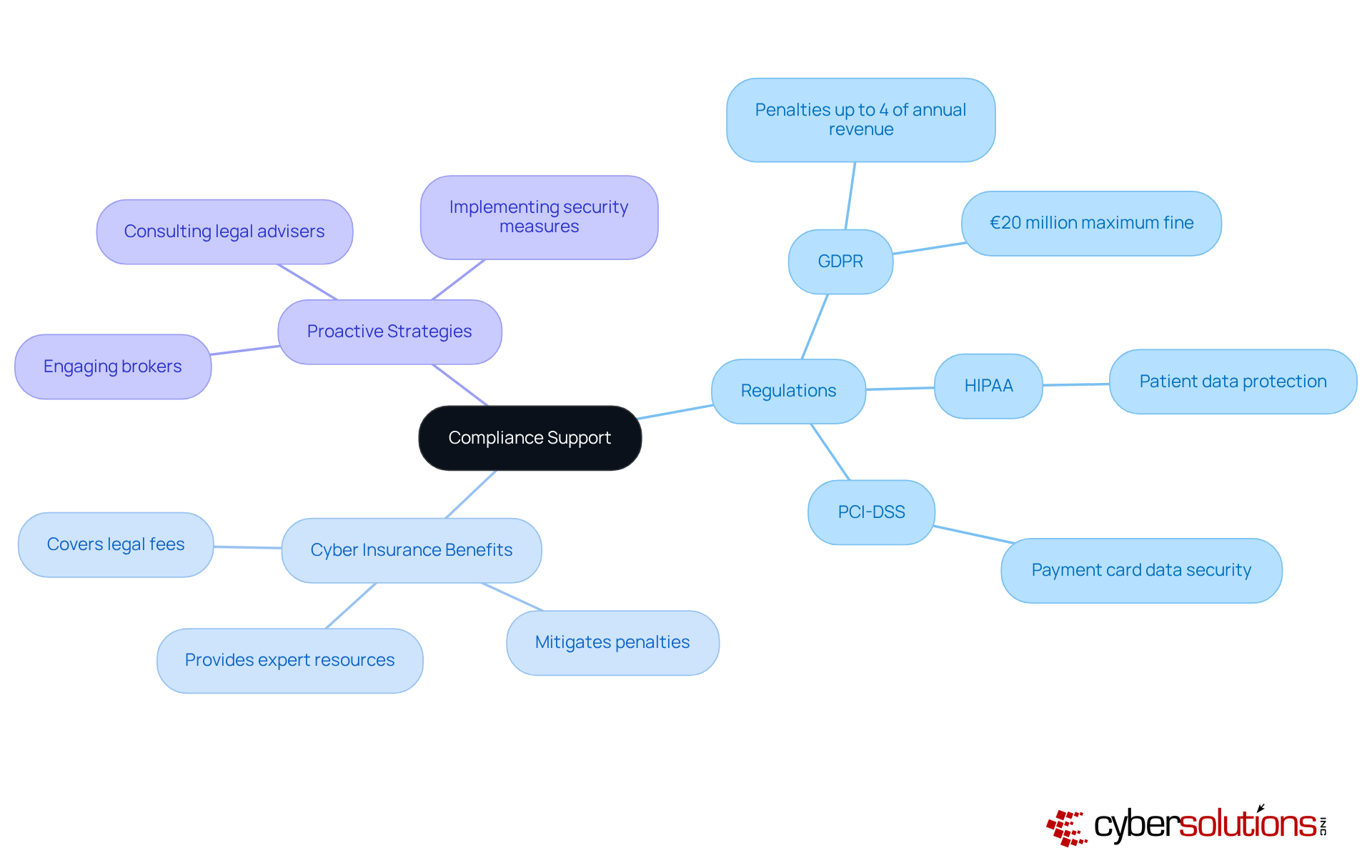

In today's highly regulated landscape, the importance of adhering to data protection laws such as GDPR, HIPAA, and PCI-DSS cannot be overstated for businesses. Cyber protection plays a pivotal role in assisting organizations with compliance, covering legal fees and potential fines stemming from non-compliance. Did you know that GDPR violations can lead to penalties of up to 4% of annual global revenue or €20 million? This stark reality underscores the necessity of as a crucial safeguard.

Furthermore, numerous insurers provide valuable resources and expert advice to help organizations implement essential security measures, thereby ensuring compliance and minimizing risk exposure.

Legal experts stress that engaging with brokers and legal advisers is critical for policyholders to fully understand their coverage and navigate the complexities of these regulations effectively. This proactive approach not only mitigates risks but also enhances overall organizational resilience in the face of evolving regulatory demands.

As the landscape of cybersecurity threats continues to evolve, organizations must remain vigilant and equipped to tackle these challenges head-on.

Cyber coverage is paramount in reinforcing customer trust in an organization's commitment to data security. When clients observe that a business has proactively implemented extensive to safeguard their data, it fosters a sense of safety and confidence. This trust is critical; research indicates that companies with robust cybersecurity measures are perceived as more reliable, leading to increased customer loyalty and an enhanced brand reputation.

Notably, 62% of companies with digital protection report heightened customer confidence, providing a competitive advantage in today's market. Branding specialists assert that the visibility of digital protection not only mitigates risks but also serves as evidence of a company's dedication to safeguarding sensitive information.

A recent case study involving a healthcare provider exemplifies this principle; their swift response and multi-layered approach not only contained a ransomware threat but also strengthened their security measures, resulting in a 30% increase in customer satisfaction ratings following the incident. This proactive strategy not only alleviated immediate threats but also bolstered their reputation as a trustworthy entity in the healthcare sector.

Organizations that prioritize digital protection can significantly enhance their brand reputation, positioning themselves as dependable allies in an increasingly digital landscape.

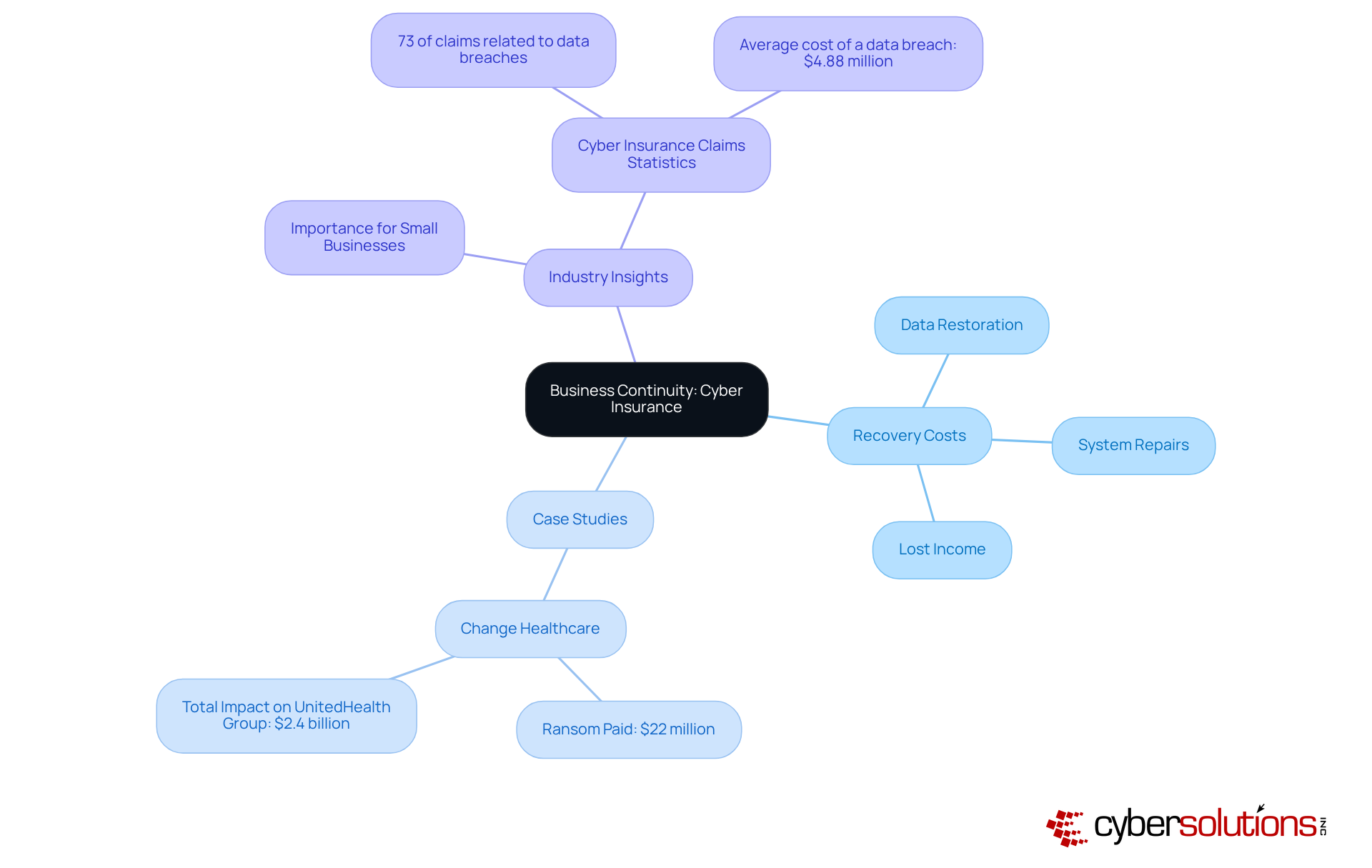

Digital coverage is vital for operational continuity, enabling organizations to swiftly recover from online incidents. In the wake of a data breach or cyberattack, this coverage addresses various recovery costs, including:

For instance, companies facing ransomware attacks often rely on their digital security coverage to mitigate financial losses, with recovery expenses averaging over $2.5 million per incident. Such financial support not only sustains operations but also minimizes disruptions, fostering long-term resilience.

Moreover, entities like Change Healthcare exemplify the effectiveness of digital protection policies in managing the fallout from significant breaches. In a notable case, Change Healthcare paid a ransom of $22 million, resulting in a total impact of approximately $2.4 billion on UnitedHealth Group. This underlines the in navigating crises.

Industry specialists emphasize that having cyber insurance for small businesses is increasingly recognized as a proactive strategy for addressing risks associated with online threats. This growing awareness underscores the importance of integrating cyber insurance for small businesses into comprehensive continuity strategies, ensuring organizations are well-equipped to confront the challenges posed by contemporary online threats.

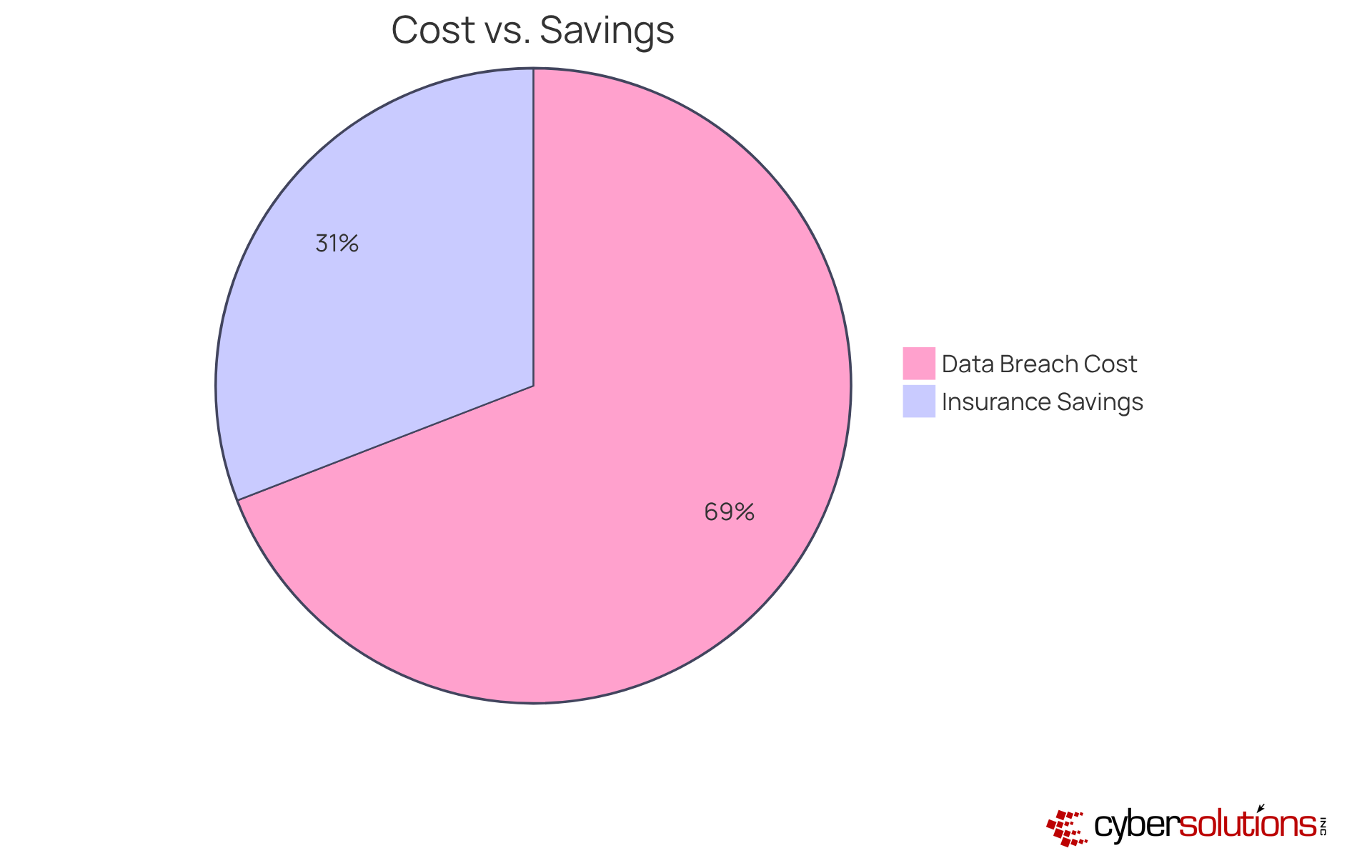

Investing in cyber insurance for small businesses is a strategic financial choice, providing significant cost-effectiveness. While premiums may initially appear as an extra expense, the potential financial repercussions of a digital incident can be staggering. For example, the average cost of a data breach globally is approximately $3.86 million, whereas, in the U.S., it reached $8.64 million in 2020. This stark contrast underscores the necessity of having coverage in place to mitigate substantial losses and ensure access to essential recovery resources.

Moreover, cyber protection not only shields against immediate financial impacts but also promotes long-term financial stability. By covering costs related to data recovery, legal fees, and customer notifications, businesses can avert crippling expenses that threaten their operations. Financial analysts emphasize that businesses demonstrating proactive risk management through enhanced cybersecurity measures may reduce their coverage expenses, thereby increasing their return on investment. As Lauren Winchester notes, "companies must remain alert and not lose focus, as the key to effective risk management is anticipating it."

In the long run, the financial advantages of investing in online security coverage can be substantial. With , as highlighted by AmTrust, having a robust coverage plan can be the difference between recovery and closure. As the digital protection market is projected to expand to $22.5 billion by 2025, it is clear that companies are recognizing the critical role of coverage in their risk management strategies. Thus, the long-term savings and protection offered by cyber insurance for small businesses position it as an essential investment for small enterprises navigating the complexities of today's online landscape.

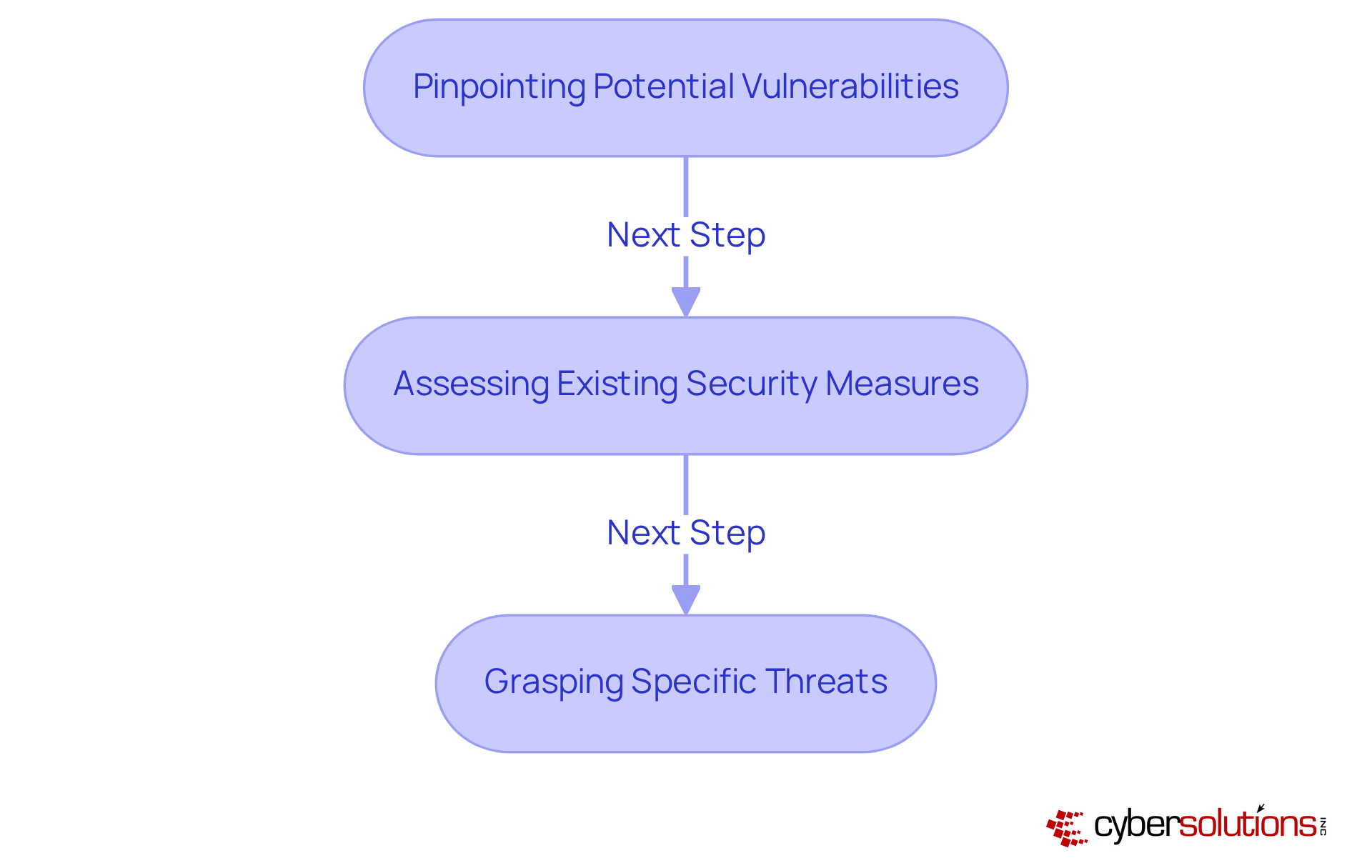

For minor enterprises striving to secure appropriate cyber insurance for small businesses, conducting a comprehensive risk evaluation is imperative. This critical process involves:

With a staggering 41% of minor enterprises experiencing a , securing cyber insurance for small businesses is not just beneficial; it is essential for survival. A thorough understanding of the risk environment empowers organizations to make informed decisions regarding cyber insurance for small businesses, ensuring robust protection against digital threats.

Moreover, statistics reveal that only 14% of small enterprises can effectively mitigate cyber risks, highlighting the urgency of considering cyber insurance for small businesses. For example, Efficient Services Escrow Group faced a devastating loss of $1.5 million due to insufficient cybersecurity measures, illustrating the financial consequences of neglecting risk evaluation. Cybersecurity experts assert that recognizing vulnerabilities is crucial for determining coverage requirements in cyber insurance for small businesses, as it enables organizations to tailor their protections to address specific threats.

At Cyber Solutions, we assist you in developing HIPAA-compliant policies and procedures while integrating multifactor authentication (MFA) and other proactive strategies that can significantly diminish vulnerabilities and lower insurance premiums. As specialists emphasize, MFA is no longer a mere option; it has become a fundamental necessity for every small and medium-sized enterprise. By prioritizing risk evaluations, minor enterprises can enhance their security posture and ensure they are adequately protected against the evolving landscape of digital threats.

As we approach 2025, the landscape of digital risk coverage is poised for significant transformation. Heightened digital threats and increasing regulatory pressures are compelling insurers to implement more stringent coverage requirements. This shift is underscored by the fact that:

Furthermore, advancements in technology are facilitating the development of more sophisticated coverage products aimed at addressing emerging risks, such as ransomware and data breaches, which constituted 60% of large claims in the first half of 2025. Notably, ransomware was implicated in 88% of data breaches at small and medium-sized enterprises, underscoring the unique risks these organizations face and the need for cyber insurance for small businesses.

To effectively counter these threats, continuous is essential, ensuring that suspicious activities are identified and mitigated before escalating into significant threats. Small enterprises must remain vigilant and informed about trends in cyber insurance for small businesses to ensure they are adequately prepared and can capitalize on new opportunities in the evolving insurance market. This includes comprehending how regulatory frameworks influence coverage and recognizing the necessity of robust third-party risk management programs, which are increasingly mandated by insurers.

To bolster their cybersecurity posture, small enterprises should implement proactive measures, including:

By adapting to these changes and executing these strategies, small businesses can enhance their resilience against cyber threats and effectively secure their operations through cyber insurance for small businesses.

In the rapidly evolving digital landscape of 2025, cyber insurance emerges as an indispensable resource for small businesses. As organizations face increasing cyber threats, including ransomware and data breaches, the necessity of tailored cyber coverage cannot be overstated. Investing in comprehensive cyber insurance not only safeguards vital data but also fortifies businesses against significant financial losses, ensuring operational continuity and enhancing stakeholder trust.

Key insights highlight the alarming statistics surrounding cyber incidents:

This underscores the importance of customized policies that align with specific business needs, proactive monitoring, and compliance with regulatory frameworks. Real-world examples illustrate the devastating consequences of inadequate coverage, reinforcing that cyber insurance is not merely a safety net but a crucial component of a robust risk management strategy.

Ultimately, the call to action is clear: small businesses must prioritize cyber insurance as a strategic investment to navigate the complexities of digital threats. By taking proactive measures, conducting thorough risk assessments, and collaborating with specialized providers like Cyber Solutions Inc., organizations can enhance their resilience, protect their operations, and secure a sustainable future in an increasingly perilous digital environment.

Why is cyber insurance necessary for small businesses?

Cyber insurance is essential for small businesses as it provides protection against digital threats, which have become increasingly prevalent. Many small enterprises underestimate their vulnerability to cyberattacks, and without insurance, they risk significant financial losses that could threaten their operations.

What types of cyber threats are small businesses facing in 2025?

In 2025, small businesses are facing a rise in various digital threats, including ransomware, phishing, and data breaches. These threats have intensified in complexity, making cyber insurance a crucial component of risk management.

What are the average costs associated with cyberattacks for small businesses?

The average recovery cost from a cyberattack for small businesses can reach approximately $120,000. This includes expenses related to legal fees, data recovery, and potential regulatory fines.

How does Cyber Solutions Inc. support small businesses with cyber insurance?

Cyber Solutions Inc. provides a comprehensive suite of tailored cyber insurance options, robust 24/7 network monitoring, and alert services to identify vulnerabilities and potential threats. Their customized approach ensures that clients receive protection that aligns with their financial strategies.

What are the consequences of not having cyber insurance for small businesses?

Without cyber insurance, small businesses face severe financial repercussions, including the risk of ceasing operations after a significant cyberattack. Nearly 60% of small enterprises that experience a major attack may close within six months.

What proactive measures do insurers require for cyber coverage?

Many insurers now require small businesses to implement basic cybersecurity measures to qualify for coverage, promoting proactive security practices that help mitigate risks.

Can cyber insurance help with recovery from cyber incidents?

Yes, cyber insurance can help small businesses recover swiftly from incidents by covering costs associated with data breaches and ransomware attacks, thereby maintaining operational continuity.

What is the importance of a layered cybersecurity approach?

A layered cybersecurity approach, which includes rapid incident response and specialized expertise, is crucial in effectively managing threats. It can significantly reduce the likelihood of future breaches and improve overall security measures.

How can small businesses assess their cybersecurity needs?

Small businesses should regularly evaluate their cybersecurity posture and consider acquiring comprehensive digital protection to shield against potential financial setbacks from cyber incidents.